how are 457 withdrawals taxed

Employees are taxed on distributions from a 457 retirement plan if the distributions are includible in the participants income. Earnings on the retirement money are tax-deferred.

Pin By Kimberlee Erickson Daugherty On Financial Freedom Investing For Retirement Retirement Money Investment Accounts

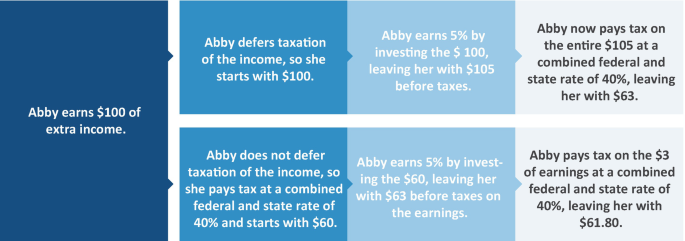

Contributions to a 457 b plan are tax-deferred.

. You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are. Basic Reporting Requirements Employers report any distribution from a 457 plan on Form W-2 the annual Wage and Tax Statement that arrives each January for payments made in the previous. Posted November 11 2014.

Withdrawals are subject to income tax. When the participant retires and starts to take distributions from their account those distributions are taxed as regular. 27000 if age 50 or older In the 457 Plan you may choose to make pre-tax contributions andor Roth after-tax contributions.

A 457 b is similar to a 401 k in how it allows workers to put away money into a special retirement account that provides tax advantages letting you grow your savings tax. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. Contributions to your 457 b are deducted from your paycheck and may be taxed in one of two ways.

If a 457 government plan permits an employee who is over age 50 by the end of the tax year or his or her employer may also be able to make catch-upcontributions in excess. Beneficiary distributions avoid the early withdrawal penalty of. Yes a governmental 457 b.

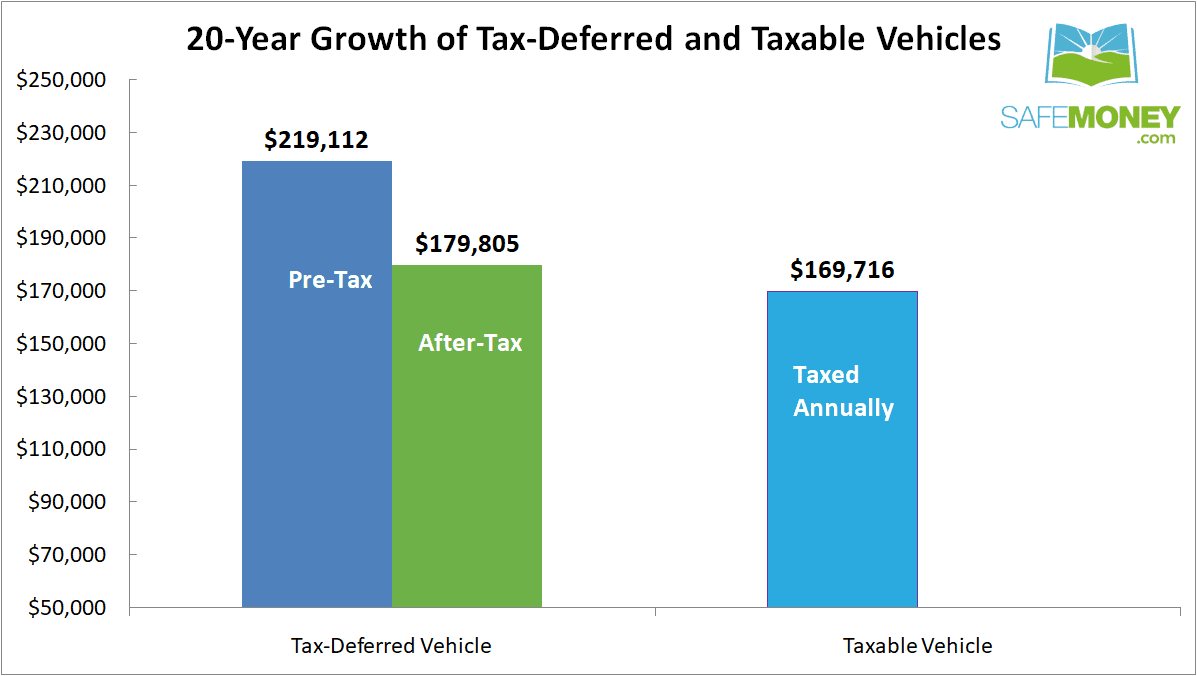

Can a 457 b plan include designated Roth accounts. In my experience if a non-profit employer discusses the implications of 457 f in advance with a competent professional it will know how 457 f. The money in a 457b grows tax-deferred over time.

Withdrawals are subject to income tax. With a 457 plan you can put pretax money into the account where it will grow untaxed until retirement when youre taxed on each distribution. 457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. The answer to that is Yes you can roll over any amount you want as often as you want 457 b plan permitting but these rollovers will generally be taxable unless the rollover. A distribution is not included in income.

With a traditional 457 b your contributions are taken out of your paycheck. There are a couple of ways a. However you will have to pay.

You will however owe income tax on all withdrawals regardless of your. 457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. The 457 is similar to the more widely known 401k plan where you can choose to contribute to the 457 plan through automatic deductions from your paycheck before the taxes.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. Availability of statutory period to correct plan for failure. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

Rollovers to other eligible retirement plans 401 k 403 b governmental 457 b IRAs No. There is no set tax applied to 401k withdrawals. Unlike with 401 ks and 403 bs the IRS wont slap you with a penalty on withdrawals you make before age 59.

Beneficiary distributions avoid the early withdrawal penalty of 10 percent.

Tax Planning And The Ten Commandments Springerlink

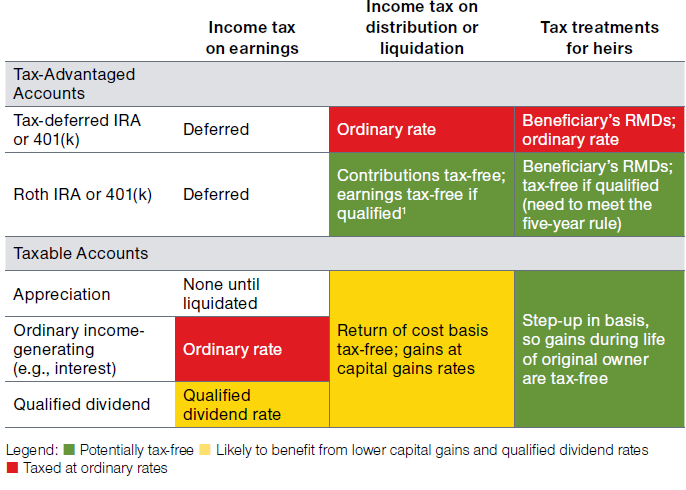

The Hierarchy Of Tax Preferenced Savings Vehicles

How Can Taxes Affect The Growth Of Your Money Safemoney Com

Getting Started What Is A 457 Plan A Tax Advantaged Deferred Compensation Retirement Plan Created By Section 457 Of The Internal Revenue Code Ppt Download

The Hierarchy Of Tax Preferenced Savings Vehicles

What Are Defined Contribution Retirement Plans Tax Policy Center

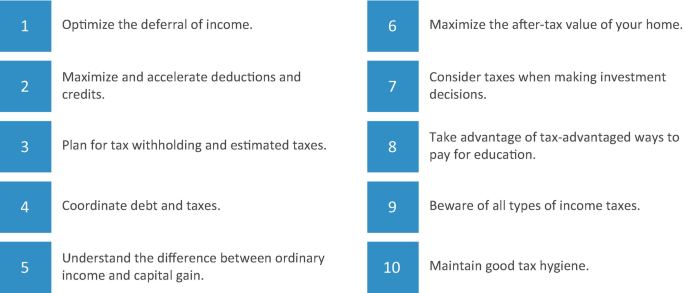

Tax Planning And The Ten Commandments Springerlink

Withdrawing Money From An Annuity How To Avoid Penalties

Retirement Income Calculator Faq

Withdrawing Money From An Annuity How To Avoid Penalties

Capital Gains Tax What Is It When Do You Pay It

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

How Are Annuities Taxed For Retirement The Annuity Expert

How To Make Your Retirement Account Withdrawals Work Best For You T Rowe Price

A Guide To 457 B Retirement Plans Smartasset

Should You Pay Off Your Home With Retirement Funds Pros And Cons

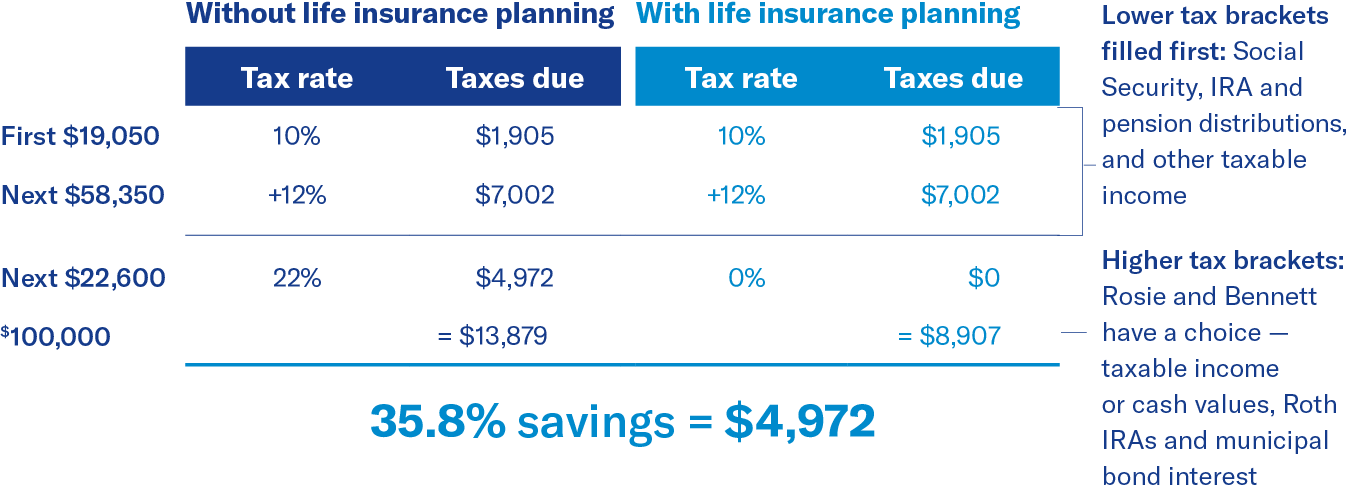

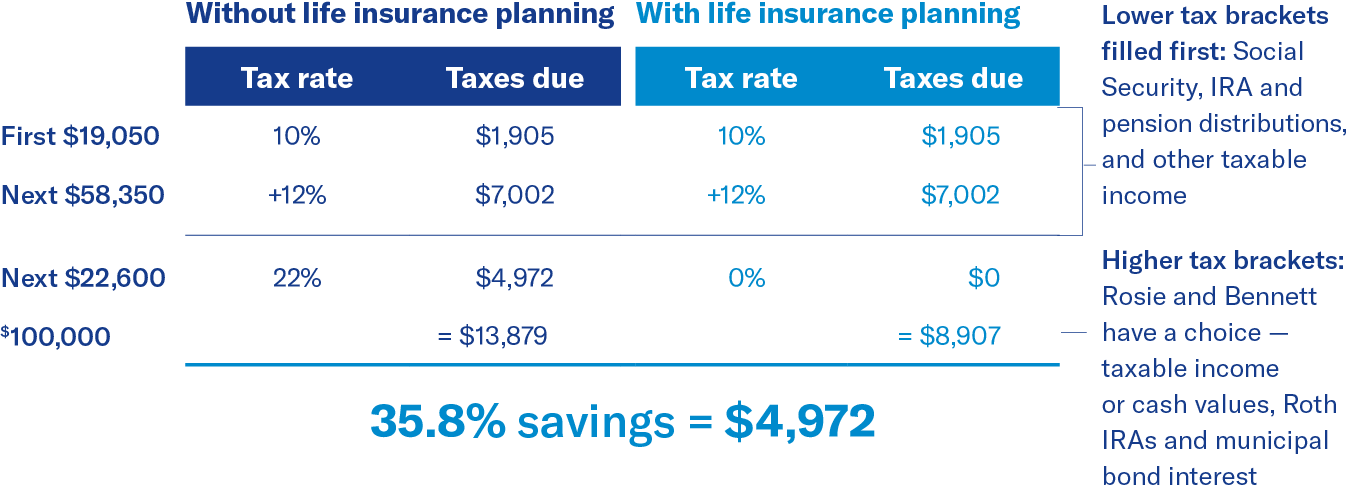

Using Life Insurance To Help Minimize Taxes In Retirement

Taxes In Retirement Three Tax Planning Tips

What Is Fica Tax Understanding Payroll Tax Requirements Freshbooks Resource Hub